Household Intelligence

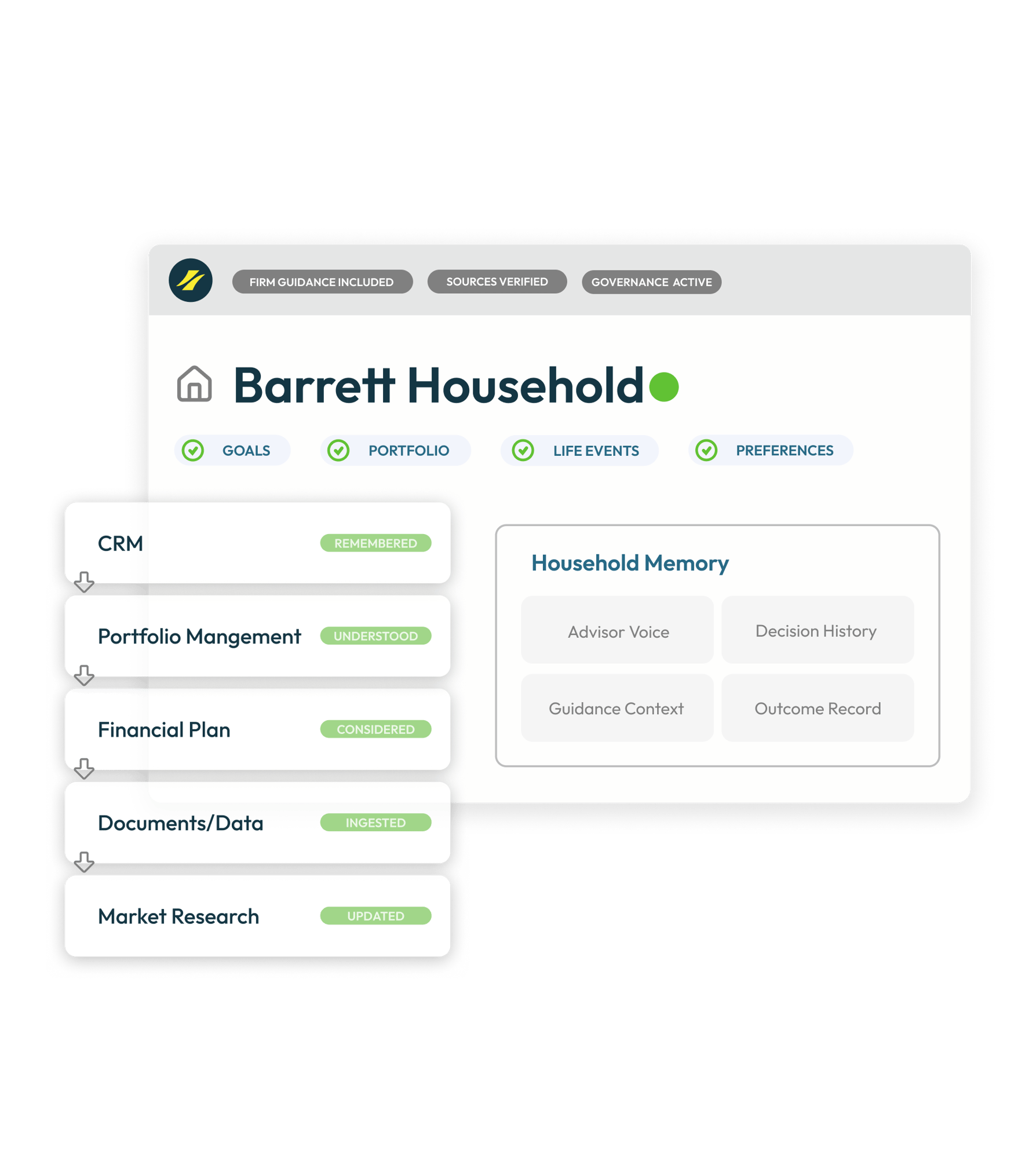

Turn CRM data, portfolio exposure, and conversation history into a complete household view, instantly.

Try Hamachi free for 14 days. Early access pricing starts at $25 per month*.

* Starter plan pricing. Usage limits apply. See FAQs for details.

Markets move. Clients hesitate. Cash builds. Positions drift. Most RIAs don’t miss opportunity because they lack insight, they miss it because signals are scattered across CRM notes, portfolio systems, and inbox threads.

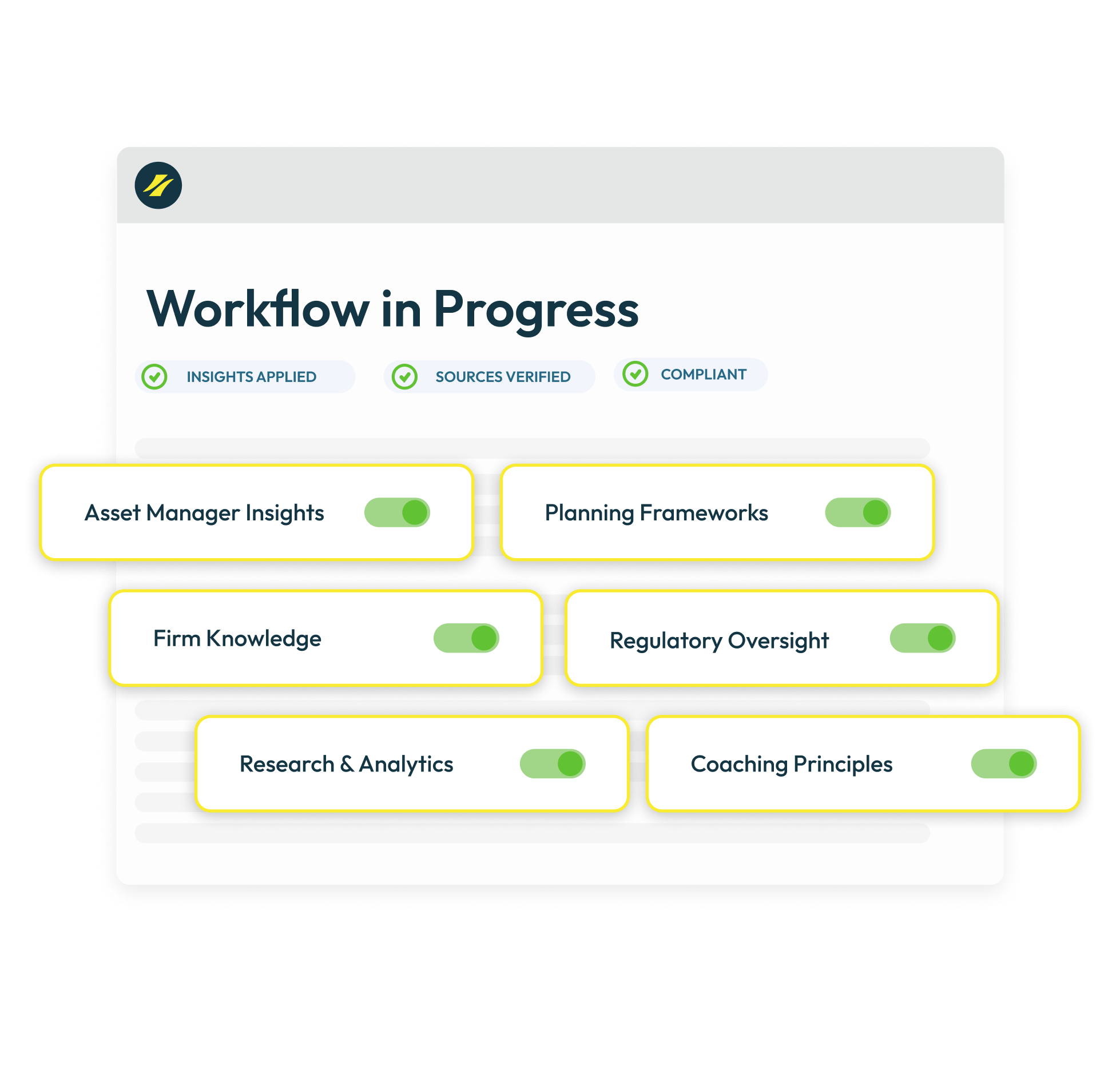

AI for financial advisors should surface what matters. But in regulated wealth management, it must do so within SEC and FINRA compliance guardrails.

Hamachi connects CRM data, portfolio systems, and expert guidance to generate structured, compliant insight:

The result: RIAs move first, strengthen client relationships, and deploy AI safely inside regulated wealth management workflows, without relying on generic AI tools.

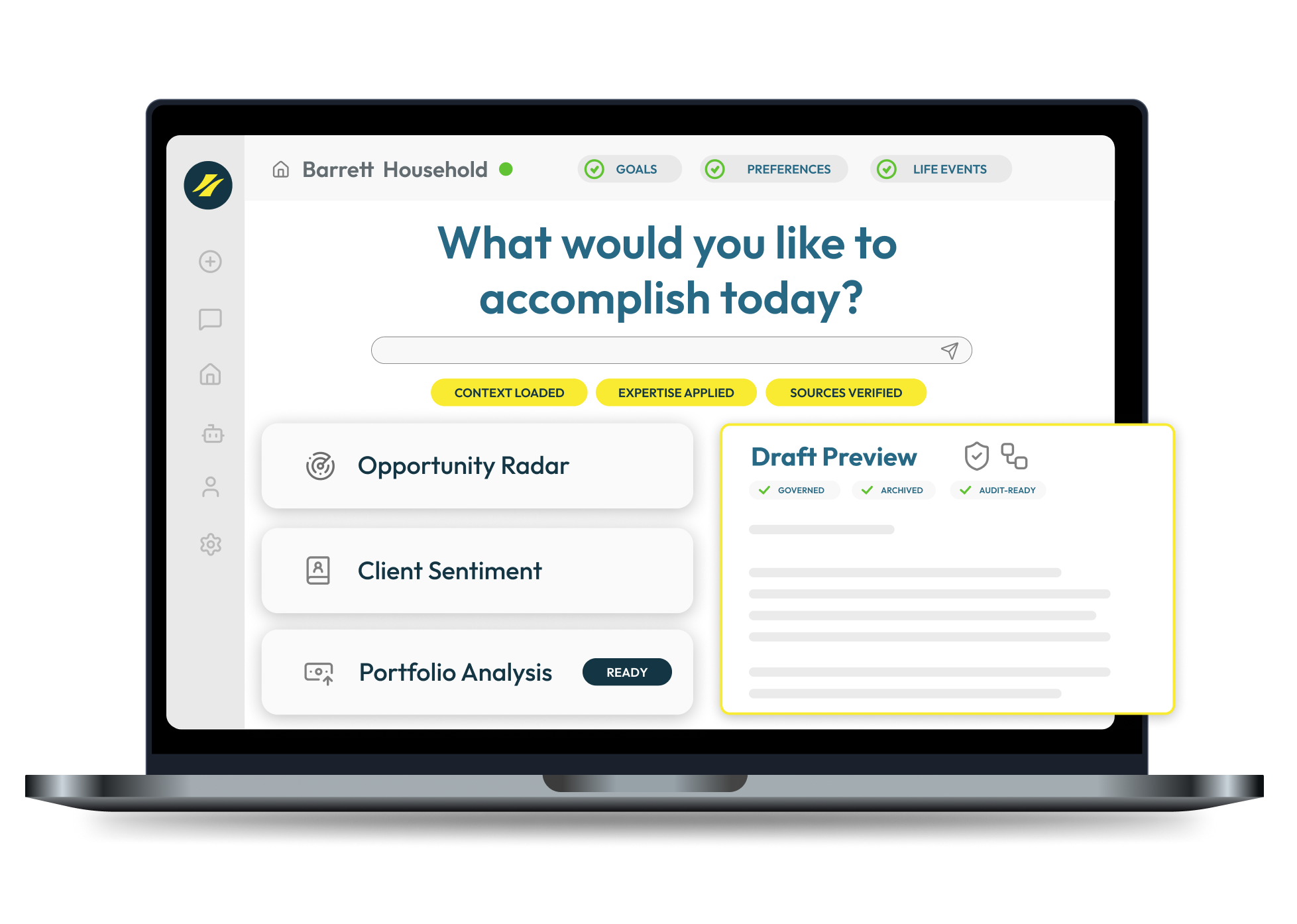

Turn CRM data, portfolio exposure, and conversation history into a complete household view, instantly.

Surface risk, drift, engagement gaps, and portfolio triggers, enriched with industry expertise at the moment of action.

SEC & FINRA-aware compliance checks, PII redaction, and full observability, with audit-ready logs and firm-level oversight.

Hamachi ensures context, intent, and decision history accumulate over time instead of resetting with every interaction.

Stop reconstructing context. Start compounding it.

Integrated with Your Wealth Tech Stack

Hamachi brings expert industry intelligence directly into advisor workflows with no extra research, tool switching, or guesswork.

When signals appear (e.g. concentration, excess cash, RMD watch, engagement gaps) Hamachi applies the right expertise instantly.

As seen in

Hamachi embeds enterprise guardrails directly into the AI lifecycle creating a secure boundary between sensitive firm data and AI models.

Trusted output at scale source-grounded, privacy-protected, and audit-ready.

I’ve found 5 opportunities across your book and flagged 3 clients for outreach.

The Mag 7 is up premarket, impacting 73% of your AUM. Here’s how we move first…

"This is one of the first AI platforms we’ve seen that truly aligns with how advisors work. Hamachi combines personalization with the compliance framework our advisors and firms require."

Brian Kobel

Enterprise Technology Solutions @United Planners

"Hamachi gives our advisors the confidence to use AI without compromising compliance. It’s the first platform that truly understands regulated wealth workflows."

Alex Murguria

Managing Director @McLean

"This is one of the first AI platforms we’ve seen that truly aligns with how advisors work. Hamachi combines personalization with the compliance framework our advisors and firms require."

Brian Kobel

Enterprise Technology Solutions @United Planners

"Hamachi turns AI from a compliance risk into an operational advantage — especially across marketing and investment committee processes."

Laura Hubbell